If you’re like most homebuyers, you’re likely shopping around to get the lowest interest rate possible on your mortgage. So what factors, and how do you get the best deal on a mortgage interest rate? You could reach out to a mortgage loan originator (at OneTrust Home Loans, of course) and ask the somewhat loaded question, or you can continue reading to learn about the top 5 factors that determine your mortgage interest rate.

There are many factors that can influence your mortgage interest rate, such as the location, price of the home, as well as the loan amount. Pricing can vary from state to state, which is why shopping around with local lenders should be a must on your checklist. While location, price and loan amount are important, there are 5 key factors that you should focus on to get the best interest rate possible.

1. Credit Score

According to Credit Karma, your credit score is a three digit number calculated from your data-rich credit report and is one factor used by lenders to determine your creditworthiness for a mortgage, loan, or credit card. The higher the score, the lower the risk for the lender. Which means, if you have a higher credit score, you’ll likely be able to get a lower interest rate than the guy next to you with a lower credit score.

Before shopping around, it’s important to do some research and get your credit report. Check out our what’s in a credit score blog now if you’re interested in learning more.

2. Down Payment

Don’t fear the mortgage down payment! There are plenty of ways to get into your dream home without putting 20 percent or more down. That doesn’t go without saying that the higher the down payment, the lower the interest rate. This is because lenders will see a lower level of risk when you hold a larger stake in the property. The size of your down payment will definitely influence the interest rate you’re offered.

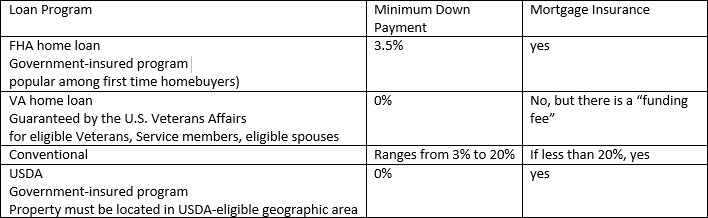

Below is a chart that outlines the typical minimum down payments required across various home loan programs:

3. Loan Term

The term or length of the loan will affect your monthly mortgage payment, how much interest you will pay over the life of the loan, and of course, your interest rate. The shorter term loan options (15 year fixed) will typically hold lower interest rates, while the longer term (30 year fixed) will typically have higher interest rates.

4. Type of Interest Rate

Interest rates come in two basic types: fixed and adjustable. Fixed interest rates don’t change over the term of your loan. Adjustable rates have an initial fixed period, after which they can fluctuate up or down depending on the market.

5. Type of Loan Program

Maybe you’re familiar with the basic loan programs; Conventional, FHA, and VA loans. Choosing the right mortgage for your home financing situation depends on a variety of factors. Working with a mortgage lender that offers a broad selection of mortgage programs is key. And not to toot our own horn, we do offer quite a few programs. Rates can adjust significantly depending on the loan program you choose, so make sure to explore your options.

There you go! Now you’re on your way to getting the best interest rate possible. If you’re ready to shop around for that great interest rate, feel free to give our team a call for a quote at (877) 706-5856 today!