Do you hear the words “mortgage down payment” and start shaking in the knees? For many millennials and first time homebuyers, thinking of how to come up with a home down payment seems like a far off dream in Neverland. Well it’s like anything in life, once you actually learn about it, understand it and come up with an attack strategy, it doesn’t have to be so scary. So read on to learn more about mortgage down payments including the different options with various mortgage programs, down payment assistance programs and gifts.

What is a mortgage down payment?

A mortgage down payment is the chunk of money you spend upfront to buy a home. For example, when someone says they put 5% down on a home, they’re referring to the money they spent upfront, as a percentage of the home sales price.

Home Sales Price: $250,000

Down payment 5% or $12,500

Loan amount: $237,500

Typical mortgage down payments by mortgage program

As a general rule, your down payment amount will depend on the mortgage program your mortgage lender is able to offer you. Mortgage lenders will say, based on your credit history, debts, income, and a bunch of other factors that go into getting pre-approved, you qualify to get “X loan” for “X amount.”

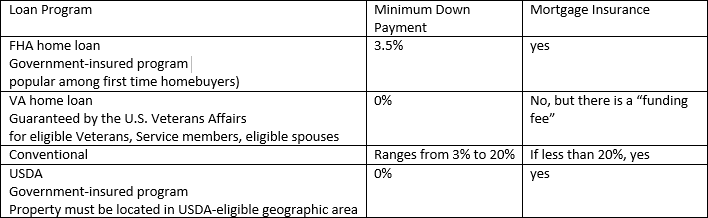

Below is a chart that outlines the typical minimum down payments required across various home loan programs:

As you can see, there are definitely mortgage options where you don’t have to put any money down to buy your home. You’ll also notice that the “government” programs offer the lowest down payment options.

Want to know more about these programs? Give us a call or check out some of the information we have on these programs:

What is mortgage insurance?

In a nutshell, by opting to put a smaller down payment towards your home purchase, the trade-off is you often have to pay mortgage insurance. Mortgage insurance helps to eliminate some of the risk should you default on the loan (since you put very little down…) It varies from program to program and situation to situation, but as an example, with a FHA home loan, you might find yourself paying an upfront mortgage insurance premium, in addition to a monthly mortgage insurance payment.

Down payment assistance programs

Does 3.5% on a home priced at $500,000 still sound like too much? Understandable as $17,500 isn’t chump change, but if you’re living in a high-priced market, it could very well be the reality.

Especially if you’re a first time homebuyer, it’s prudent and wise of you to find out if your local city, county or state offers special programs to help with down payments for home purchases. For example, the San Diego Housing Commission offers a First-Time Homebuyer Program to purchase a single family home, townhome or condo in the city of San Diego. Since its inception it has helped over 5,230 families buy their first home!

Gifting Down Payments

If you’ve got an awesome parent, grandma, fiancé or other charitable family member that wants to contribute to helping you buy a home, let the party begin as they can help you come up with a home down payment by gifting it to you.

Some general guidelines:

- The “gifter” or donor must be a family member (there may be exceptions allowed, doesn’t hurt to ask!)

- The amount you’re eligible to receive as a gift towards your down payment depends on your mortgage program

- Your mortgage lender must be able to track the gifts

- The donor may need to provide proof of their ability to gift, usually in the form of a bank statement

- You and the donor will both sign a letter verifying the funds are a gift and explicitly state that it isn’t a loan

Also, when you start to talk with family members about gifts, be sure you look into tax implications. The donor may potentially have tax implications, if the gift is over a certain amount. Good news for you, is you won’t have any tax implications.

Look into the annual gift tax exclusion law, and the lifetime gift tax exclusion law as these amounts can change every year.

Want to know more about home down payments? Do you have specific questions? Feel free to give us a call and we can provide all of the details, and tailor it to your specific situation. It’s easy, so why not? Call us today! 877-706-5856.